- Relevant data sources identification and information value assessment

- Credit Scoring and bureau scores. Propensity scoring and segmentation tools. Digital propensity and sustainability assessment

- Scenario analysis, benchmarking and planning. Pre-screening, targeting and cross selling. Customers portfolio management: credit risk and sales opportunities

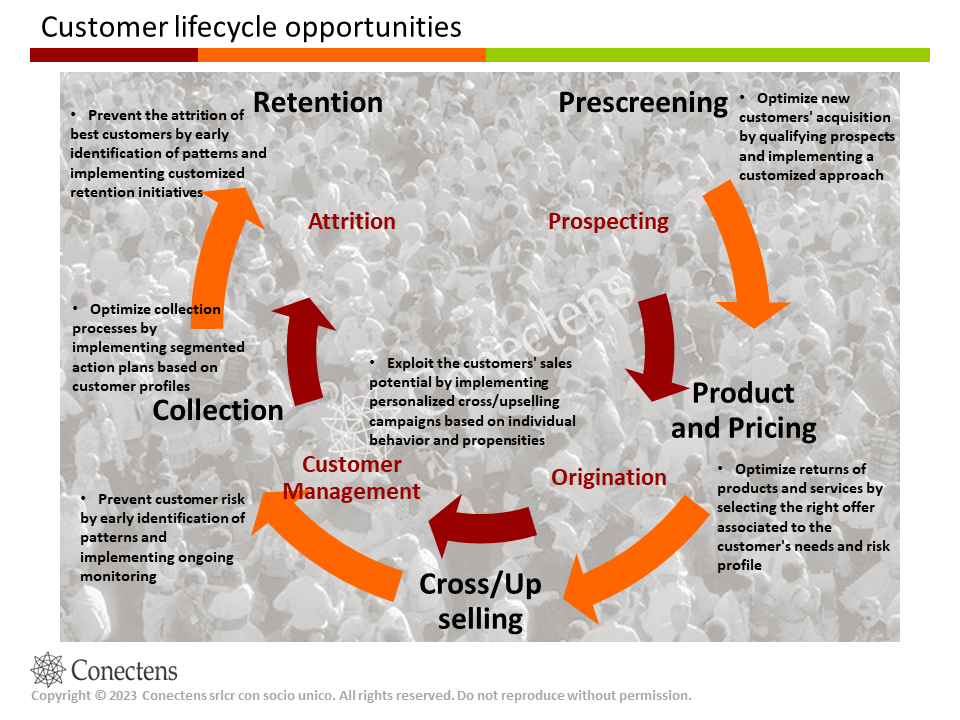

- Enhance performances for each step of the customer lifecycle: prospecting, origination, customer management and collection, retention

- Optimise new customers acquisition. Exploit the customers’ sales potential and prevent the attrition of best customers. Early identification of the customer risk and tailored collection processes

- Support to achieve strategic and operational business goals

- Bureau Data and Credit Scoring: credit bureau data and predictive modelling for credit risk management

- Analytics tools for customer management: data based algorithms for business decisions related to each stage of the customer lifecycle

- Digital propensity and sustainability assessment of customers and prospects: new opportunities arising and impact on competitiveness

ABOUT US

We specialize in providing tailored analytics, consultancy, and training services to businesses looking to optimize their credit risk and customer relationship management strategies. From scenario analysis and benchmarking to pre–screening, targeting and cross selling, our services are designed for each stage of your customers’ lifecycle, optimizing new customer acquisition, exploiting the sales potential of existing customers, and preventing the attrition of best customers. Our team of experts can help you identify and assess the value of relevant data sources, develop credit scoring and exploit available bureau scores, employ propensity scoring and segmentation tools, and assess customers’ digital propensity and sustainability.

Analytics, Consultancy and Training on Credit Risk and Customer Relationship Management for both

the B2C and B2B markets

0 and more

0 and more

0 and more

OUR APPROACH

-

1

Meeting final customers' needs and business opportunities

-

2

Enhance business decisions through the customer lifecycle, exploiting all available data sources

-

3

Continuously increase analytics skills to transform data into a competitive advantage

Papers and Case Studies

Stay in the loop.

View all blog posts and read more about topics you care about.

Conectens

Email: info@conectens.com